Discover The Ultimate Guide To Purchasing Carnival Shares

How or where can I purchase carnival shares?

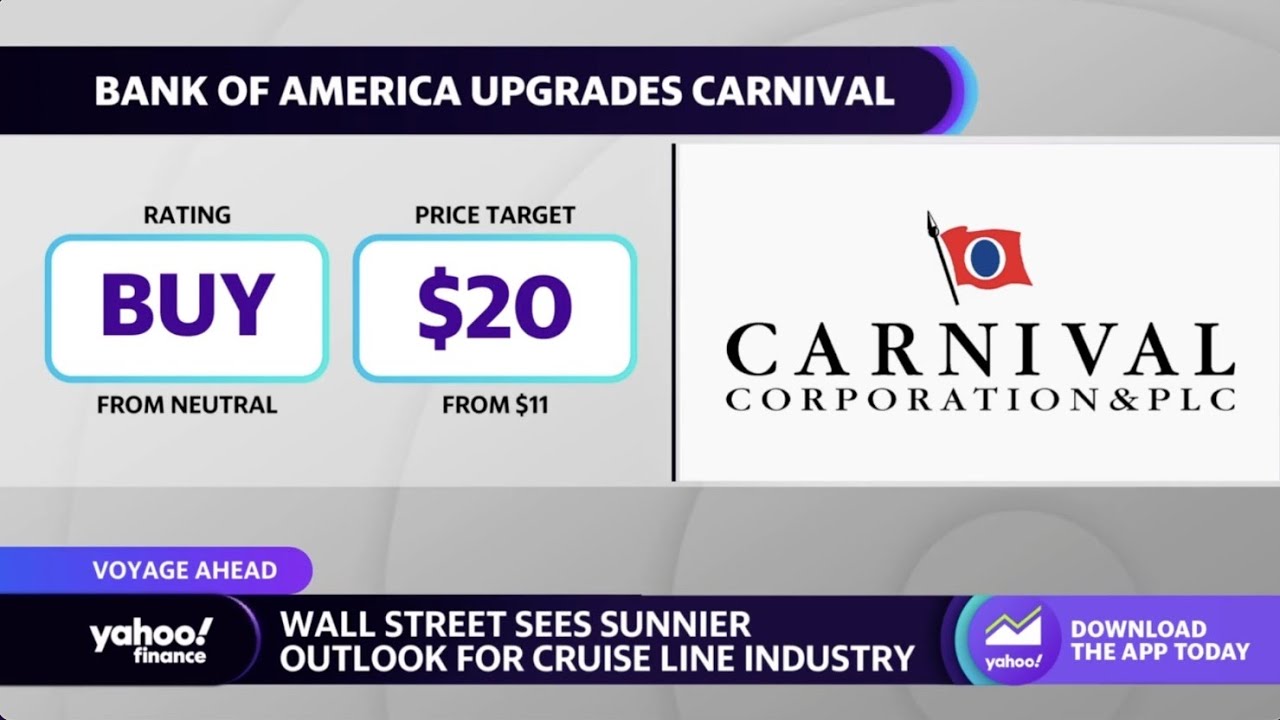

Purchasing carnival shares involves investing in the publicly traded stock of Carnival Corporation & plc, the world's largest cruise operator. Carnival shares are listed on both the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE), under the ticker symbol "CCL." To purchase Carnival shares, investors can use a reputable online brokerage platform or work with a financial advisor.

Carnival shares have been a popular investment choice for individuals seeking exposure to the leisure and tourism industries. The company has a long history of profitability and growth, and its shares have generally performed well over the long term. However, as with any investment, there are risks associated with purchasing Carnival shares. The cruise industry is cyclical and can be affected by economic downturns, geopolitical events, and natural disasters.

Despite these risks, Carnival shares have historically provided investors with solid returns. The company has a strong track record of innovation and expansion, and it is well-positioned to benefit from the growing global demand for cruise vacations. For investors with a long-term investment horizon and a tolerance for risk, purchasing Carnival shares can be a potentially rewarding investment.

Here is a table summarizing the key details about Carnival Corporation & plc:

| Company Name | Carnival Corporation & plc |

|---|---|

| Ticker Symbol | CCL |

| Exchange | NYSE, LSE |

| Industry | Leisure and Tourism |

| Headquarters | Miami, Florida, USA |

I hope this information is helpful. Please let me know if you have any other questions.

Purchase Carnival Shares

Purchasing Carnival shares involves investing in the publicly traded stock of Carnival Corporation & plc, the world's largest cruise operator. Key aspects to consider before purchasing Carnival shares include:

- Company Performance

- Industry Trends

- Economic Outlook

- Investment Goals

- Risk Tolerance

- Share Price

- Dividend Yield

Considering these aspects can help investors make informed decisions about whether or not to purchase Carnival shares. For example, investors should research Carnival's financial performance, including its revenue, earnings, and cash flow. They should also consider the overall health of the cruise industry and the economic outlook. Investors should also consider their own investment goals and risk tolerance before making a decision. Finally, investors should compare Carnival's share price and dividend yield to other similar companies.

By carefully considering all of these factors, investors can increase their chances of making a successful investment in Carnival shares.

1. Company Performance

Company performance is a key factor to consider before purchasing Carnival shares. A company's financial performance can provide insights into its overall health and its ability to generate future profits. Investors should research Carnival's financial performance, including its revenue, earnings, and cash flow. They should also consider the company's debt levels and its ability to meet its financial obligations.

- Revenue: Carnival's revenue is primarily generated from ticket sales, onboard spending, and other cruise-related activities. Investors should look for companies with consistent and growing revenue streams.

- Earnings: Carnival's earnings are its profits after subtracting all of its expenses. Investors should look for companies with strong and growing earnings.

- Cash flow: Carnival's cash flow is its ability to generate cash from its operations. Investors should look for companies with strong and positive cash flow.

- Debt: Carnival's debt levels can impact its financial flexibility and its ability to make new investments. Investors should look for companies with manageable debt levels.

By carefully considering Carnival's company performance, investors can make more informed decisions about whether or not to purchase Carnival shares.

2. Industry Trends

The cruise industry is a complex and dynamic one, with a variety of factors that can impact its performance. These factors include economic conditions, geopolitical events, and technological advancements. Investors who are considering purchasing Carnival shares should be aware of the key industry trends that could affect the company's future performance.

- Economic Conditions

The cruise industry is highly cyclical and is therefore sensitive to economic conditions. When the economy is strong, people are more likely to take cruises. Conversely, when the economy is weak, people are more likely to cut back on discretionary spending, such as cruises. Investors should be aware of the overall economic outlook before purchasing Carnival shares.

- Geopolitical Events

Geopolitical events can also impact the cruise industry. For example, if there is a terrorist attack or a natural disaster in a popular cruise destination, it could lead to a decline in demand for cruises. Investors should be aware of the geopolitical risks associated with investing in Carnival shares.

- Technological Advancements

Technological advancements can also have a significant impact on the cruise industry. For example, the development of new ship designs and propulsion systems can lead to more efficient and environmentally friendly cruises. Investors should be aware of the latest technological advancements that could affect the cruise industry.

- Regulatory Changes

Regulatory changes can also impact the cruise industry. For example, new environmental regulations could lead to increased costs for cruise lines. Investors should be aware of the regulatory landscape and how it could affect Carnival shares.

By understanding the key industry trends that could affect Carnival's future performance, investors can make more informed decisions about whether or not to purchase Carnival shares.

3. Economic Outlook

The economic outlook is a crucial factor to consider before purchasing Carnival shares. A strong economy typically leads to higher consumer spending, which can benefit companies like Carnival that rely on consumer discretionary spending. Conversely, a weak economy can lead to lower consumer spending and reduced demand for cruises. Investors should consider the following economic indicators when evaluating the economic outlook:

- Gross Domestic Product (GDP)

GDP is the total value of all goods and services produced in a country over a specific period of time. A growing GDP indicates a strong economy and can lead to increased demand for cruises.

- Consumer Confidence Index (CCI)

The CCI measures the level of confidence that consumers have in the economy. A high CCI indicates that consumers are optimistic about the future and are more likely to spend money on discretionary items like cruises.

- Unemployment Rate

The unemployment rate measures the percentage of the labor force that is unemployed. A low unemployment rate indicates a strong economy and can lead to increased demand for cruises.

- Interest Rates

Interest rates can impact the cost of borrowing for consumers and businesses. Low interest rates can make it more affordable for consumers to finance a cruise vacation, while high interest rates can make it more expensive.

By considering the economic outlook and these key economic indicators, investors can make more informed decisions about whether or not to purchase Carnival shares.

4. Investment Goals

Investment goals are a crucial factor to consider before purchasing Carnival shares. Your investment goals will help you determine the type of investment strategy that is right for you, and whether or not Carnival shares are a good fit for your portfolio.

- Time Horizon

Your time horizon refers to the length of time that you plan to invest. If you have a short-term investment horizon, then you may want to consider other investment options that are less volatile than Carnival shares. However, if you have a long-term investment horizon, then Carnival shares could be a good option for you.

- Risk Tolerance

Your risk tolerance refers to the amount of risk that you are comfortable taking with your investments. If you have a low risk tolerance, then you may want to consider other investment options that are less risky than Carnival shares. However, if you have a high risk tolerance, then Carnival shares could be a good option for you.

- Investment Goals

Your investment goals refer to the specific financial goals that you are trying to achieve. If your investment goal is to generate income, then you may want to consider other investment options that provide a more consistent stream of income than Carnival shares. However, if your investment goal is to grow your wealth over the long term, then Carnival shares could be a good option for you.

- Diversification

Diversification is a risk management technique that involves investing in a variety of different assets. Diversification can help to reduce the overall risk of your investment portfolio. If you are considering purchasing Carnival shares, then you should make sure that you are also diversifying your portfolio with other investments.

By carefully considering your investment goals, you can make more informed decisions about whether or not to purchase Carnival shares.

5. Risk Tolerance

Risk tolerance is a crucial factor to consider before purchasing Carnival shares. It refers to the amount of risk that an investor is comfortable taking with their investments. Risk tolerance is often determined by a combination of factors, including age, investment goals, and financial situation.

- Investment Horizon

An investor's investment horizon refers to the length of time that they plan to invest. Investors with a short-term investment horizon may be less tolerant of risk than investors with a long-term investment horizon. This is because short-term investments are more likely to be affected by market fluctuations.

- Investment Goals

An investor's investment goals also play a role in determining their risk tolerance. Investors who are saving for retirement may be more risk-averse than investors who are saving for a down payment on a house. This is because retirement savings are typically invested for the long term, while down payments are typically invested for the short term.

- Financial Situation

An investor's financial situation can also affect their risk tolerance. Investors who have a lot of debt or other financial obligations may be less tolerant of risk than investors who have a stable financial situation. This is because investors who are in debt may need to access their investments quickly in order to meet their financial obligations.

- Investment Experience

Investors with more investment experience may be more tolerant of risk than investors with less experience. This is because experienced investors are more likely to understand the risks involved in investing and how to manage those risks.

It is important for investors to carefully consider their risk tolerance before purchasing Carnival shares. Investors who are not comfortable with taking on a lot of risk may want to consider other investment options. However, investors who are comfortable with taking on more risk may find that Carnival shares are a good investment opportunity.

6. Share Price

The share price is a crucial factor to consider when purchasing Carnival shares. It represents the current market value of a single share of Carnival stock and is determined by supply and demand in the stock market.

- Current Share Price

The current share price of Carnival can be found on financial websites and stock exchanges. It is important to note that the share price can fluctuate throughout the day and may be different from the price at which you purchased the shares.

- Historical Share Price

The historical share price of Carnival can provide insights into the company's past performance and can be used to identify trends. Investors can use historical share prices to make informed decisions about whether or not to purchase Carnival shares.

- Factors Affecting Share Price

The share price of Carnival can be affected by a variety of factors, including the company's financial performance, the overall economy, and market sentiment. It is important to consider these factors when making investment decisions.

- Impact on Investment Decisions

The share price can have a significant impact on investment decisions. Investors who purchase Carnival shares at a low price may be able to sell them at a higher price in the future, generating a profit. However, investors who purchase Carnival shares at a high price may be at risk of losing money if the share price declines.

By understanding the share price and the factors that affect it, investors can make more informed decisions about whether or not to purchase Carnival shares.

7. Dividend Yield

Dividend yield is the annual dividend per share divided by the current market price of a stock. It represents the percentage of a stock's price that is paid out to shareholders as dividends. Dividend yield is an important consideration for investors who are looking for income from their investments.

Carnival Corporation has a history of paying dividends to its shareholders. The company's dividend yield has fluctuated over time, but it has generally been in the range of 2% to 4%. This yield is comparable to other companies in the cruise industry.

Investors who are considering purchasing Carnival shares should consider the company's dividend yield in addition to other factors such as the company's financial performance, the overall economy, and market sentiment. Dividend yield can be a valuable tool for investors who are looking to generate income from their investments.

Frequently Asked Questions About Purchasing Carnival Shares

This section provides answers to frequently asked questions about purchasing Carnival shares. This information can help investors make informed decisions about whether or not to invest in Carnival Corporation.

8. 1. How can I purchase Carnival shares?

Carnival shares can be purchased through a reputable online brokerage platform or through a financial advisor. When selecting a broker, it is important to compare fees, trading platforms, and customer service.

9. 2. What are the risks associated with purchasing Carnival shares?

As with any investment, there are risks associated with purchasing Carnival shares. These risks include the cyclical nature of the cruise industry, geopolitical events, and economic downturns. Investors should carefully consider their risk tolerance before purchasing Carnival shares.

10. 3. What is Carnival's dividend yield?

Carnival's dividend yield has fluctuated over time, but it has generally been in the range of 2% to 4%. This yield is comparable to other companies in the cruise industry. Investors should consider Carnival's dividend yield in addition to other factors when making investment decisions.

11. 4. What is the current share price of Carnival?

The current share price of Carnival can be found on financial websites and stock exchanges. It is important to note that the share price can fluctuate throughout the day and may be different from the price at which you purchased the shares.

12. 5. What factors should I consider before purchasing Carnival shares?

Investors should consider a number of factors before purchasing Carnival shares, including the company's financial performance, the overall economy, market sentiment, and their own investment goals and risk tolerance.

By understanding the risks and rewards associated with purchasing Carnival shares, investors can make informed decisions about whether or not to invest in the company.

Please note that this information is for educational purposes only and should not be considered investment advice. Investors should always consult with a qualified financial advisor before making any investment decisions.

Proceed to the next section to learn more about Carnival Corporation.

Conclusion

Purchasing Carnival shares involves investing in the publicly traded stock of Carnival Corporation & plc, the world's largest cruise operator. Carnival shares are listed on both the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE), under the ticker symbol "CCL." To purchase Carnival shares, investors can use a reputable online brokerage platform or work with a financial advisor.

Investors should carefully consider the risks and rewards associated with purchasing Carnival shares before making an investment decision. The cruise industry is cyclical and can be affected by economic downturns, geopolitical events, and natural disasters. However, Carnival has a long history of profitability and growth, and its shares have generally performed well over the long term.

Investors who are considering purchasing Carnival shares should research the company's financial performance, the overall economy, market sentiment, and their own investment goals and risk tolerance. By understanding the risks and rewards involved, investors can make informed decisions about whether or not to invest in Carnival Corporation.

Article Recommendations